UX Research / 2022

Market Research for Door-to-Door Journey Planners

Responsibilities: Market Research, Data Analysis, Reporting & Documentation

The Context

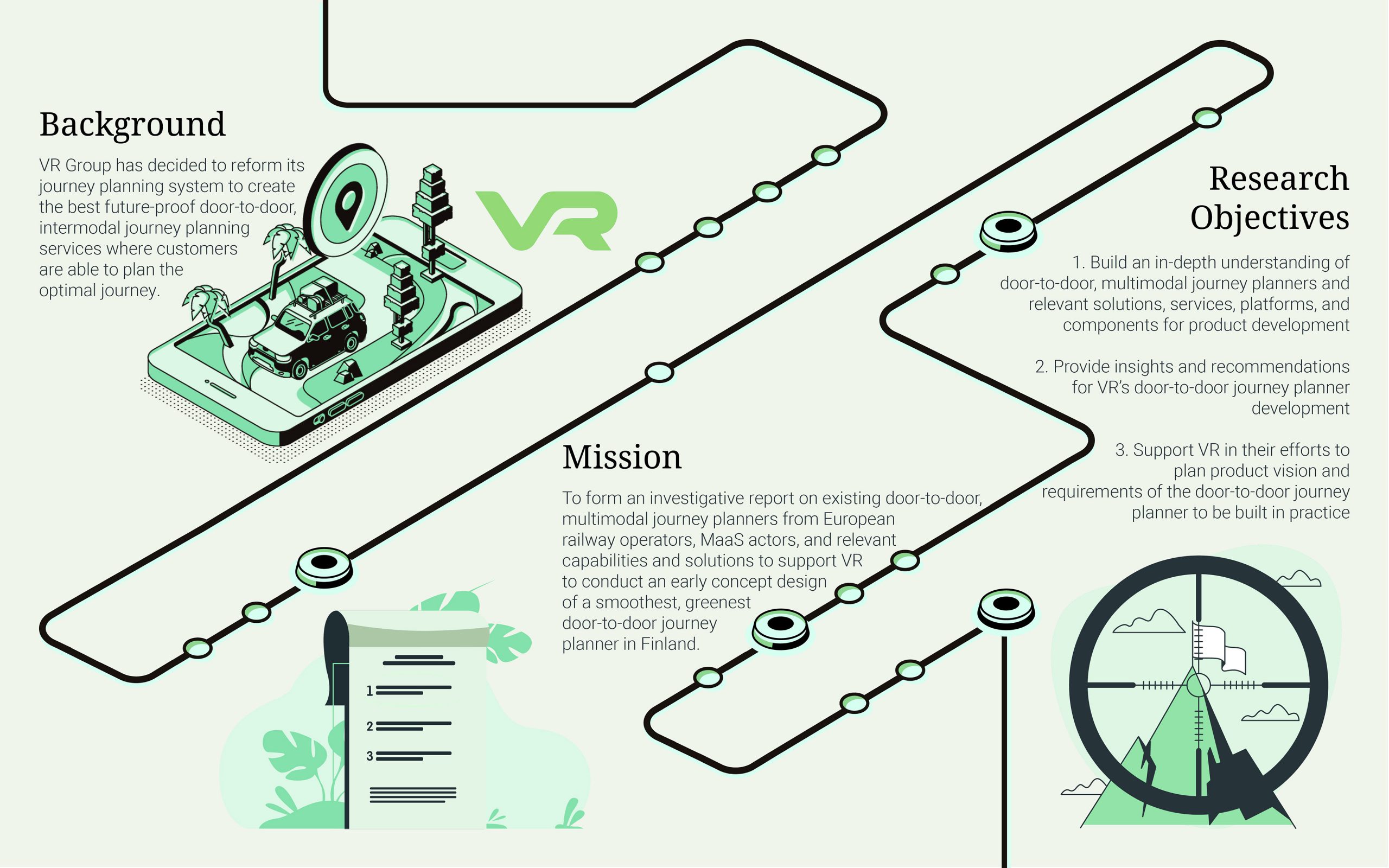

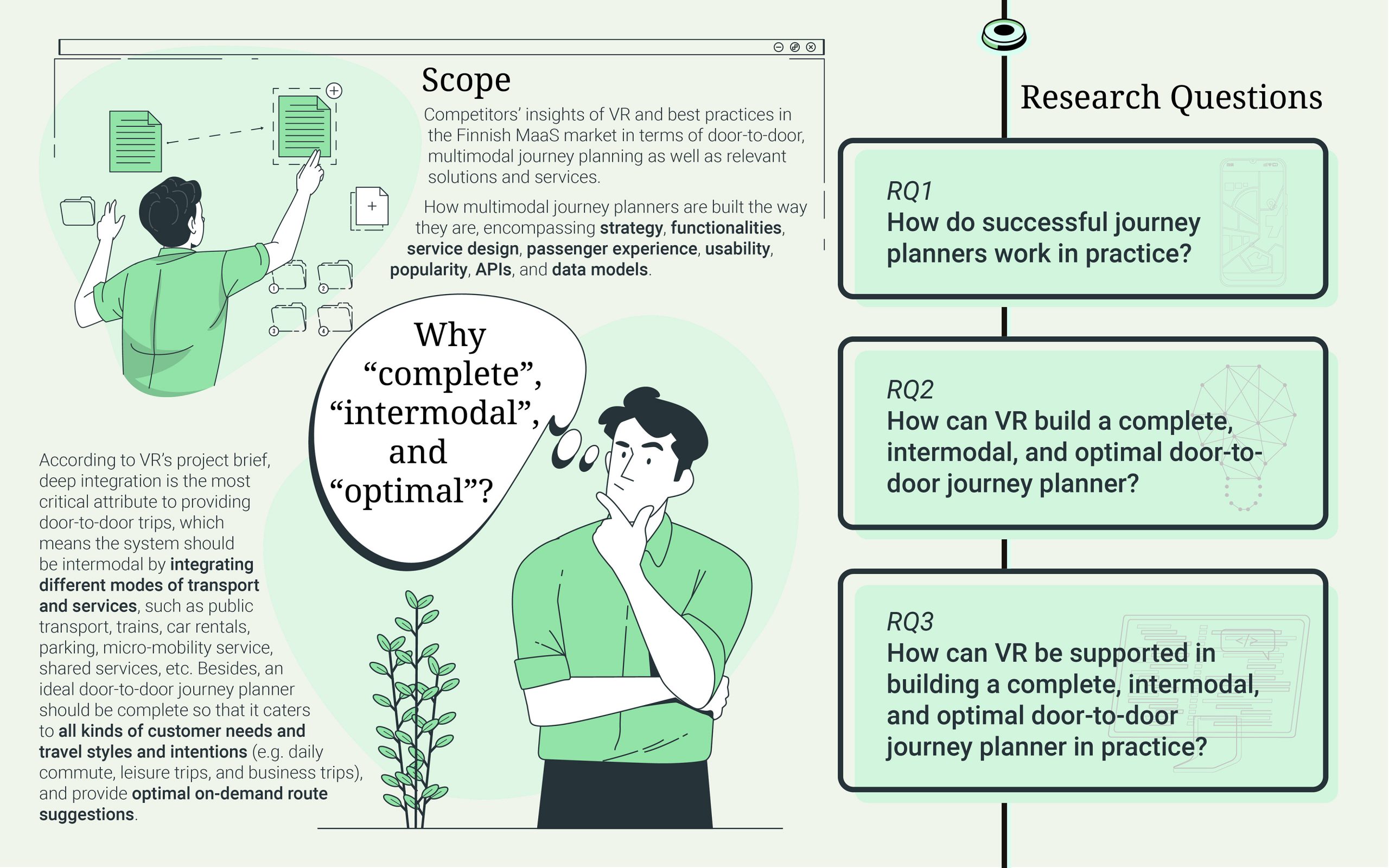

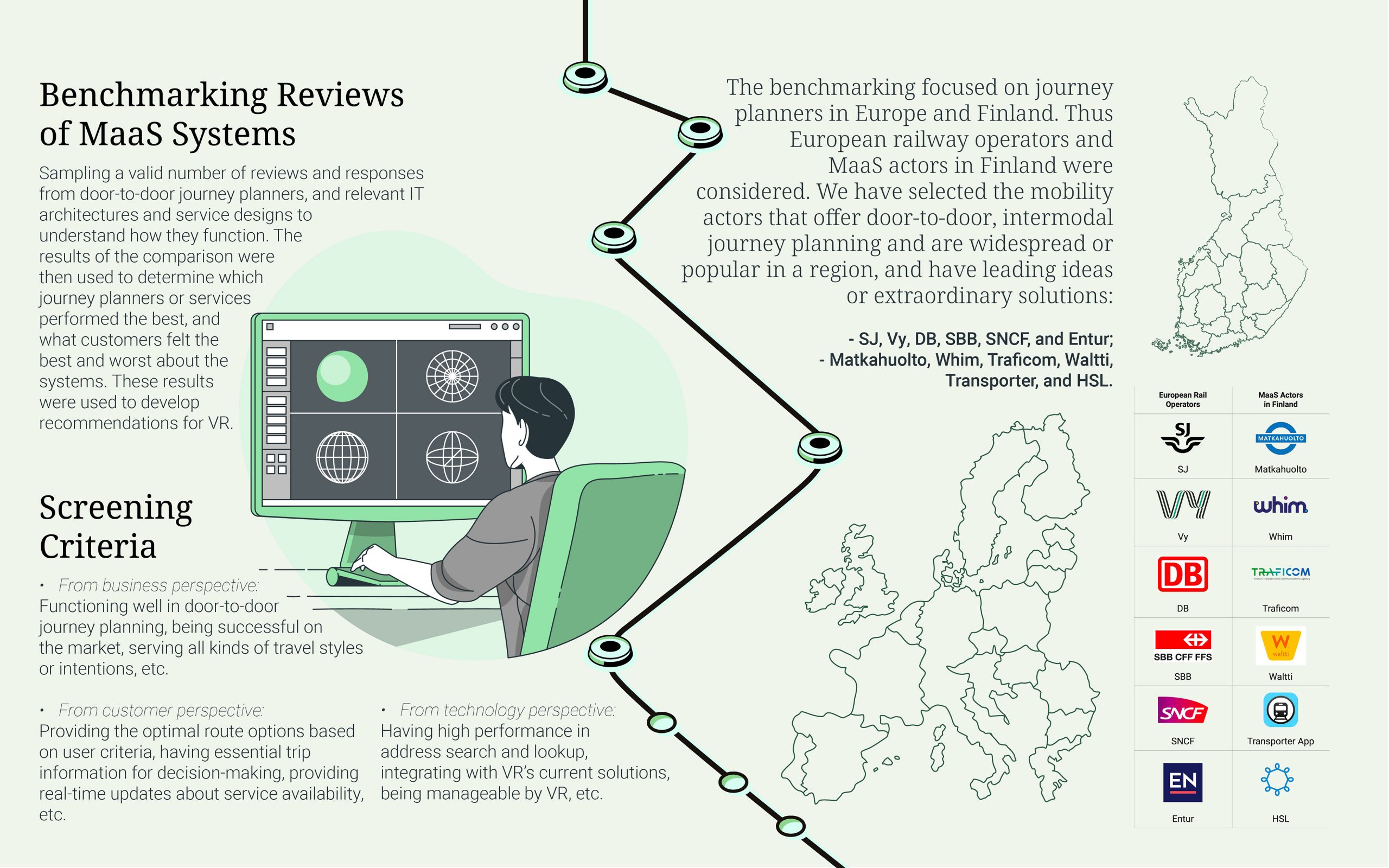

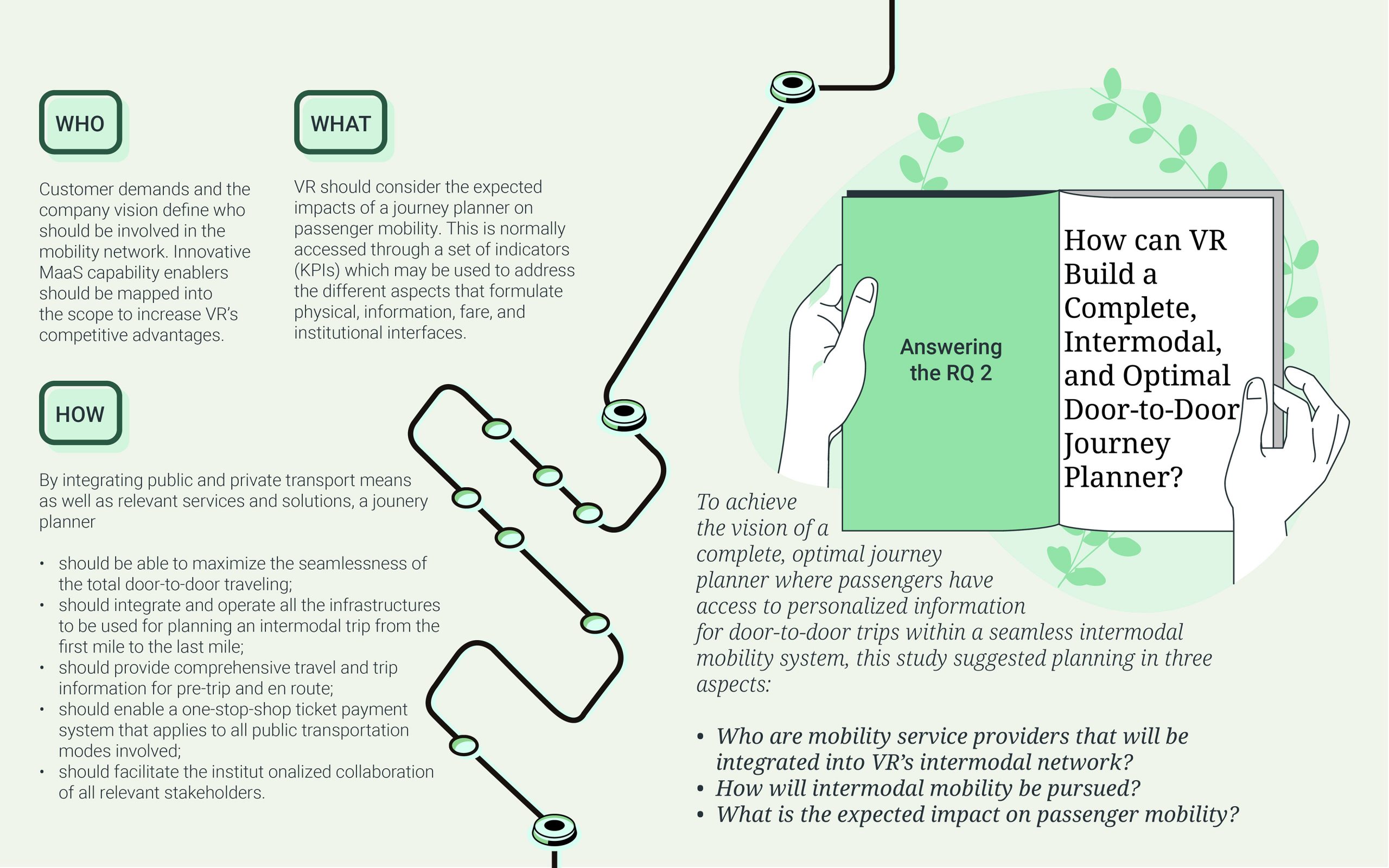

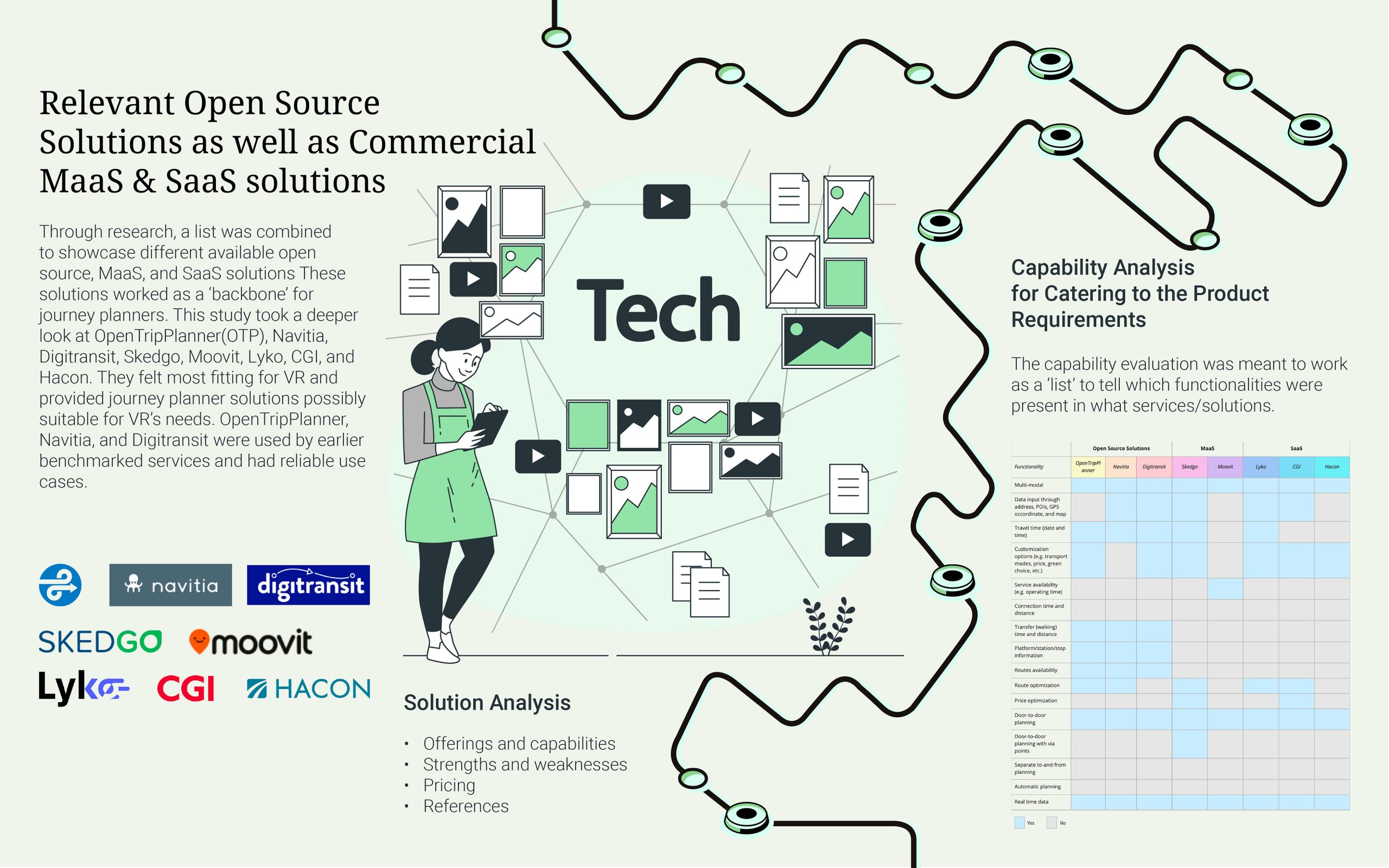

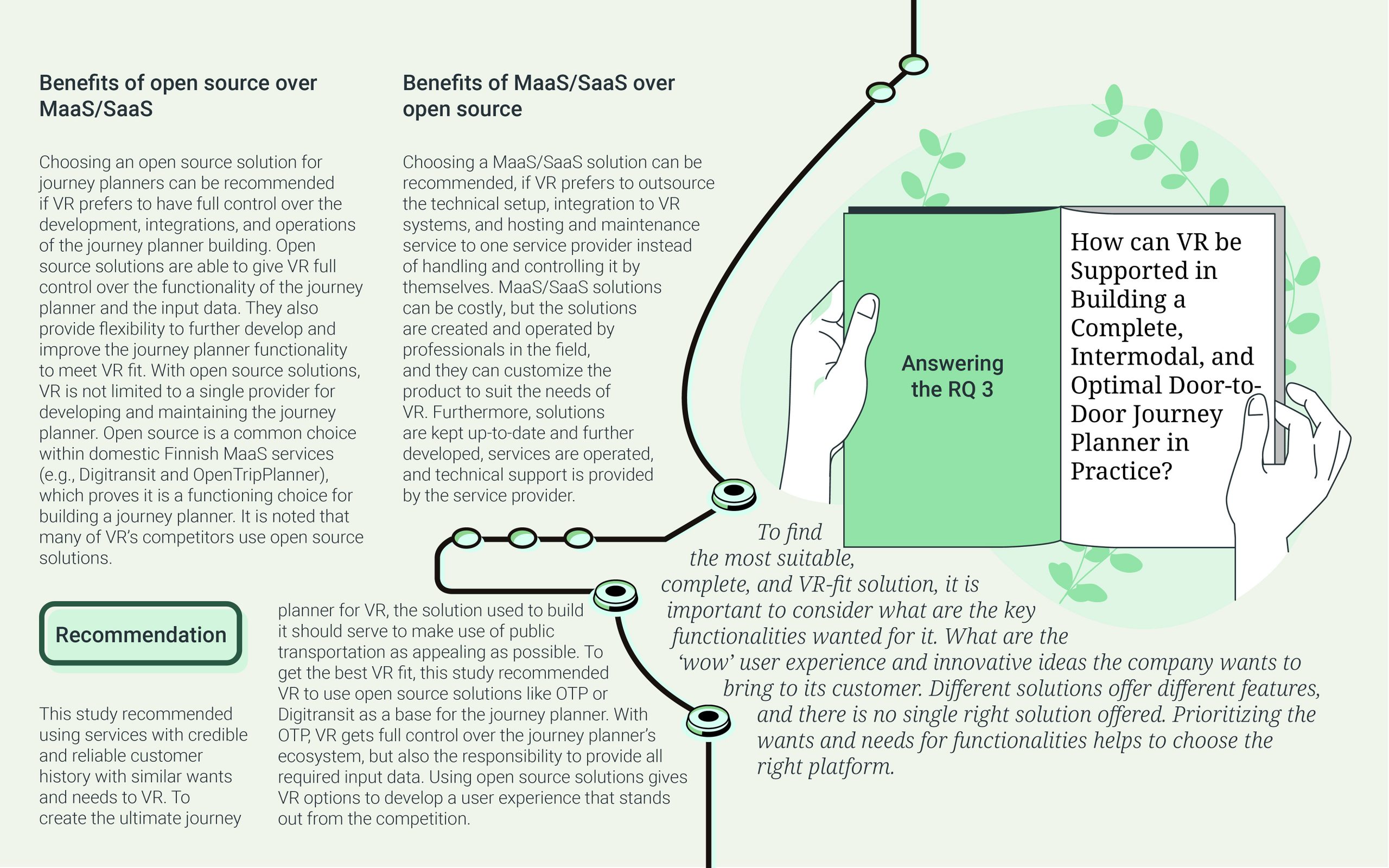

VR Group (a government-owned railway company in Finland) has decided to reform its journey-planning system to create the best future-proof door-to-door, intermodal journey-planning services in Europe where customers are able to plan the optimal journey. The solution should be scalable outside Finland. In the interest of innovating the door-to-door journey planner, the related market research must be first conducted before deciding to invest in costly development. My task was to form an investigative report on existing door-to-door, multimodal journey planners from European railway operators, MaaS actors, and relevant capabilities and solutions to support VR to conduct an early concept design of a smoothest, greenest door-to-door journey planner in Finland.

My Role

As a lead UX researcher, I led the research process covering all phases of research (planning, data collection, analysis, and reporting). I developed research plans and defined research objectives as well as research frameworks and methodologies. I provided thought leadership to the research team and the clients, effectively communicating durable insights through writing, presentations, and conversation to build consensus and persuade action based on findings. I Helped de-risk research decisions, providing advice, guidance, and coaching to other researchers to ask the right research questions, develop testable hypotheses, and design research/testing approaches to improve insight quality. Eventually, I synthesized findings and ensured the delivery of high-quality insights via a visualized, professional, client-ready research report.

#Reflection

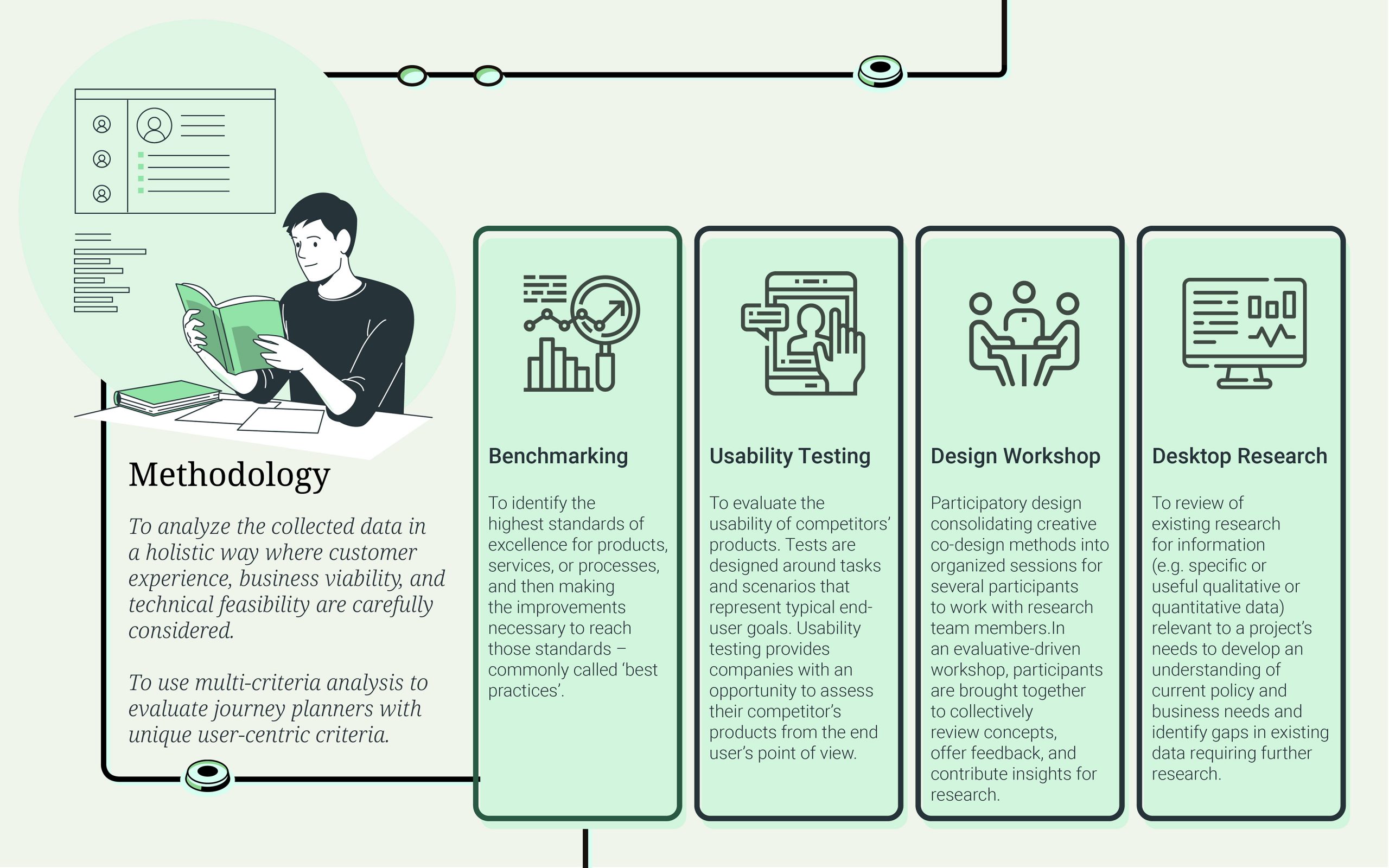

analyze them. That is, the external comparison group, whether limited to competitors or extended to companies belonging to other sectors, is based on a ranking in terms of a specific measure of overall performance (i.e., screening criteria). Within that screening the entities are identified that are at the top of the list, and then certain specific practices are analyzed. A benchmarking analysis must be conducted with great care, but at the same time, it is important to avoid excessive attention in the areas that don’t contribute to answering the research questions. In benchmarking analysis, this comparison group should not be limited not only to competitors but selecting those competitors that are similar or close to the company, also in terms of performance. If it is decided to use only competitors in the reference group, in addition to the difficulty of obtaining detailed information on their practices, the result is often limited to the reduction of a gap or reaching a situation of operational parity, but not achieving strategic advantage. The analysis is thus reduced to a single need (to know what competitors are doing) and to a dangerous and simplistic conclusion (if most of our peers adopt similar practices, then we should adopt them, too). Choosing to adopt a practice only because it is widespread does not in fact mean adopting the best practice. If it is decided to include in the reference group companies belonging to other sectors, the exchange of information can be facilitated by the absence of mutual competition. This entails the risk, however, of examining situations that are so distant that it becomes difficult to use their practices or achieve the same results. Therefore, I recommend benchmarking reference actors in and outside the domain/industry to obtain a competitive advantage with respect to competitors, so as to adopt innovative practices not yet exploited.

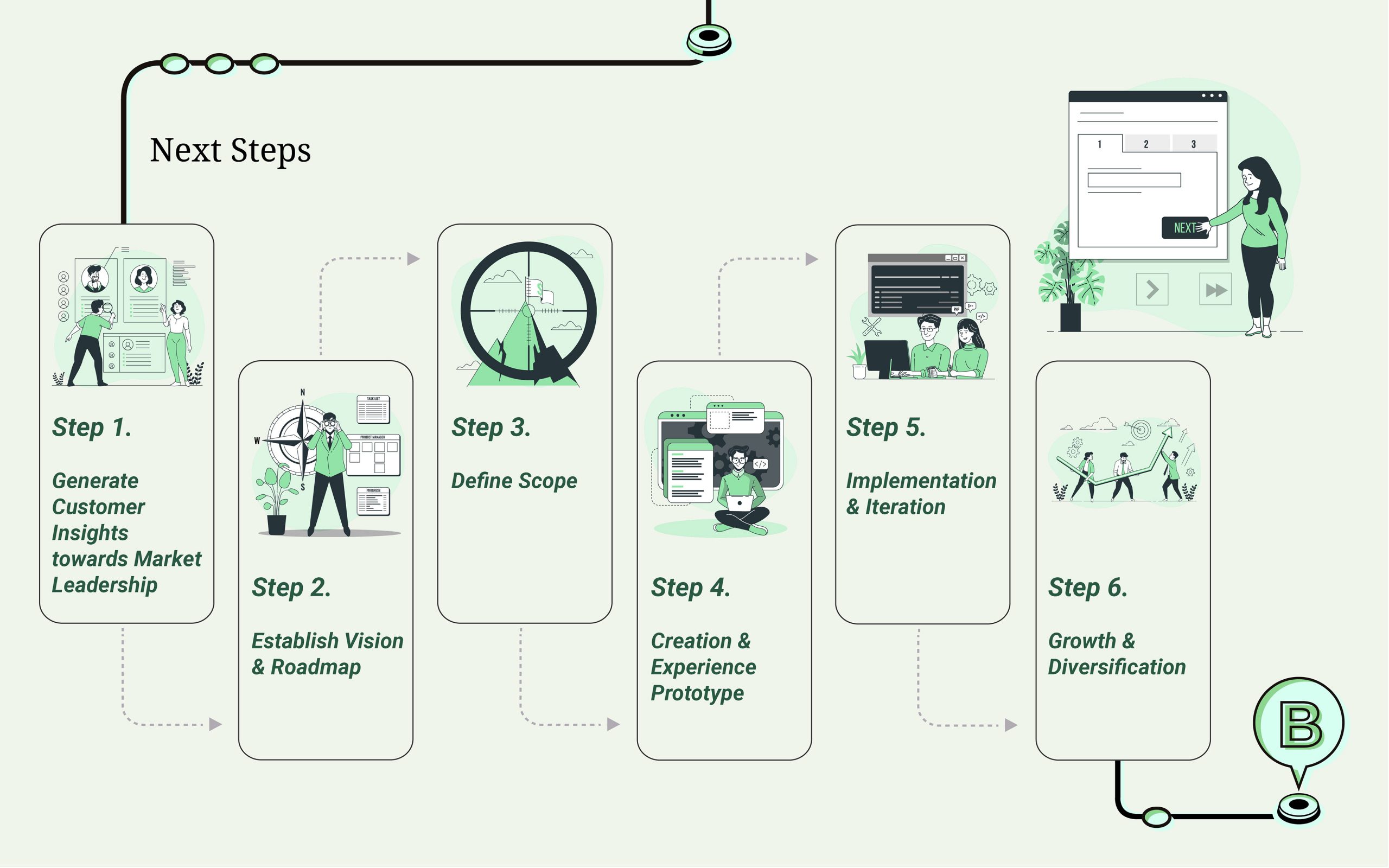

I summed up my research process in the following steps:

- What is the total size of your market?

- What percent share of the market can you potentially have?

- What is the demographic picture of your potential B2C customers (Age, Gender, Location, Income, Social class, Occupation, Education)?

- What is the demographic picture of your potential B2B customers (Industry, Location, Size of firm, Price preferences)?

- Where are your potential leads coming from?

As for qualitative data, it should answer:

- What is the current demand in your target market?

- What are the existing or new customers’ values and beliefs?

- What are the trends in the target market — growth trends, trends in consumer preferences, and trends in product development?

- What can be the growth potential and opportunity for your product and/or business of your size?